We’ve answered some of the most frequently asked questions below:

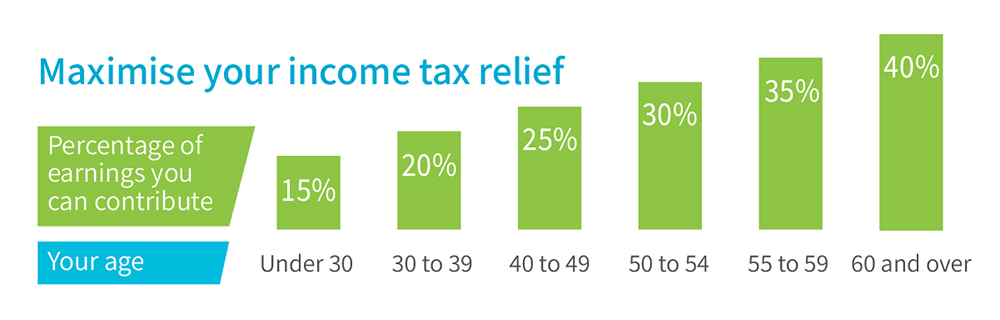

AVCs are treated like normal pension contributions for tax purposes. Therefore, like pension contributions, AVCs qualify for tax relief at your highest rate of tax (Subject to Revenue limits). Also, any investment growth achieved by your AVC fund is tax free. When you retire, the value of your AVC fund is available to improve the benefits provided by your main pension plan.

The entitlement to tax relief is not automatically guaranteed.

To find out more about AVCS click here

The below steps are for members of Defined Contribution (DC) schemes, Additional Voluntary Contribution (AVC) schemes, Personal Retirement Bonds (PRBs) and Personal Retirement Saving Account (PRSA) policies.

|

Online: If you are going online, you’ll need to be at your PC or laptop, not from your mobile phone. 1. Log onto your pension online 2. Visit the Investment Section. You will see a switch funds button, click this. 3. Follow the simple steps from there.

|

By post: 1. Simply download and complete the form here 2. Post the completed form to Irish Life Assurance plc CODE Corporate Business Lower Abbey Street Dublin 1 3. Alternatively, email the completed form to - Happytohelp@irishlife.ie |

If you would like to contact us directly you can email code@irishlife.ie or contact us on 01 7041845

If you have a Personal Retirement Bond (PRB) policy you can download and complete the form here, please remember to include the name of the fund you wish to switch to and email code@irishlife.ie, alternatively you can post this to:

Irish Life Assurance plc

CODE

Corporate Business

Lower Abbey Street

Dublin 1

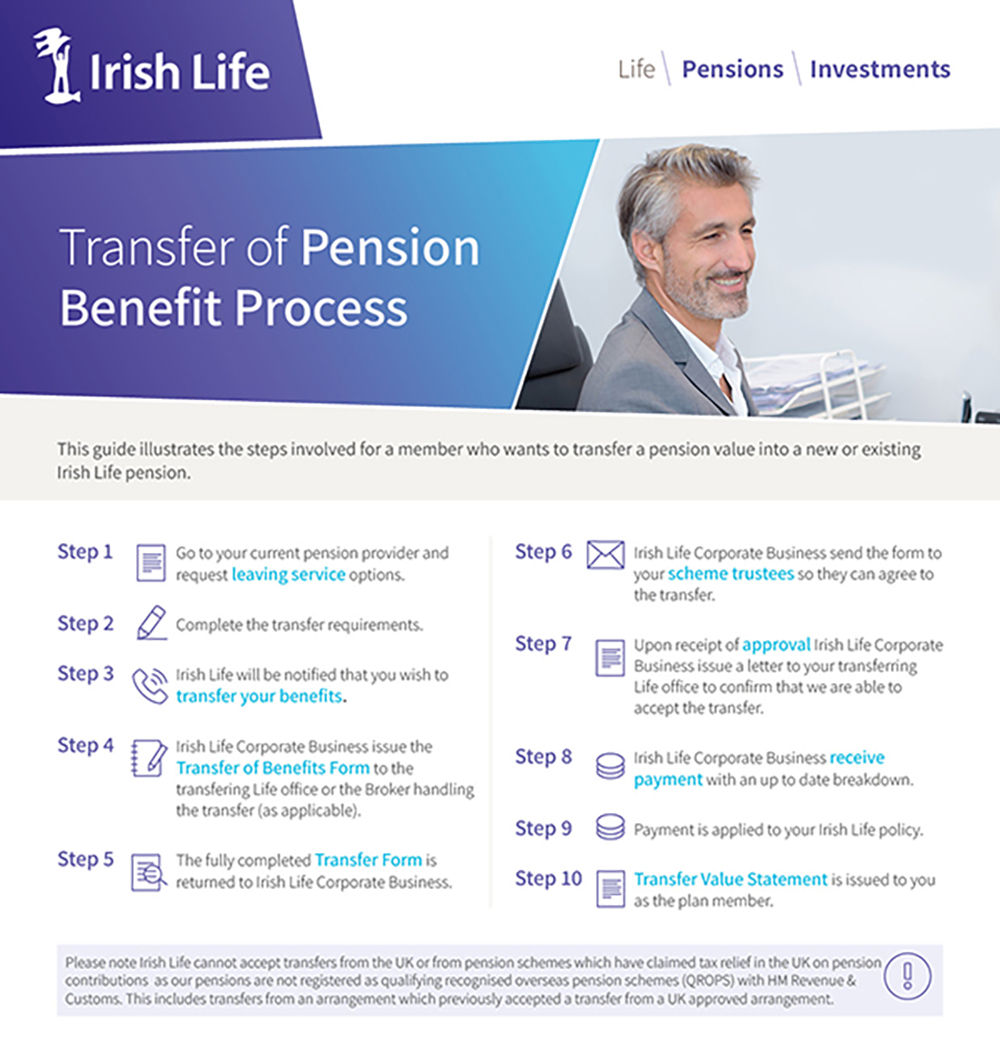

Before Irish Life, as the current pension provider, can confirm acceptance of a transfer in, we must seek approval from the receiving scheme trustees. In order to seek trustee approval, we need details of the proposed transfer.

To this end we have a Transfer of Benefits Form that can be completed by the transferring life office with the information we require. You can find the form in the Document Download Centre of our website, in the Customer Service Forms section.

To support this, we have designed a chart for members that illustrates the typical steps involved in the transfer process. This can be used as a tool to explain the process involved in transferring from one plan to another. Click on the image below to see a larger version of the step-by-step guide.

- Deferred pension - You can usually leave the value of your pension fund in your previous employer’s pension plan until you retire and then use it to get a retirement benefit.

- You may be able to transfer the value of your retirement savings to a new employer’s pension plan (if your new employer’s plan allows).

- If you do not join another company pension plan and you decide to set up a Personal Retirement Savings Account (PRSA) and you may, in certain circumstances, transfer the value of your retirement savings into it.

- You can take the value of your retirement savings from your current employer’s plan when you leave and invest in what is known as a Buy-Out-Bond or a Personal Retirement Bond (PRB). This is an individual lump-sum investment.

Should you leave your current employer within two years of being in the pension plan, you may be required to take a refund of the value of your own contributions less tax. There may be circumstances where you may also be entitled to the value of the Employer’s contributions (less 20% tax) under the EU Supplementary Pension Rights Regulations 2019. Irish Life will advise you and your Employer if this applies to you. Some plans may allow you to leave your contributions in the plan, even though they are not required to do so by law.

Under most pension plans, the value of the pension fund is paid to the estate in the event of death of the policy holder/member.

By participating in the Irish Life EMPOWER Master Trust, employers and scheme members benefit from Irish Life’s market leading technology, investment expertise, reduced costs and extensive DC scheme knowledge, with the reassurance that the scheme is being governed by the Master Trust trustees, meeting all governance standards required under pension legislation.

You may be able to take your pension benefits before NRA however, depending on your specific circumstances and the plan of which you are a member. However, the plan is designed to provide benefits at your normal retirement age and retiring early could mean your retirement savings will be less than if drawn down at your NRA.

You may be able to take retirement benefits from your pension plan earlier because of ill health, although trustee consent is normally required. If you take your benefits early, the value you get could be a lot less than if you had claimed your benefits at normal retirement age.

If you are still working and have reached normal retirement age in the employment to which the company pension plan relates to, you can claim your company pension and continue to work, assuming your employer agrees.

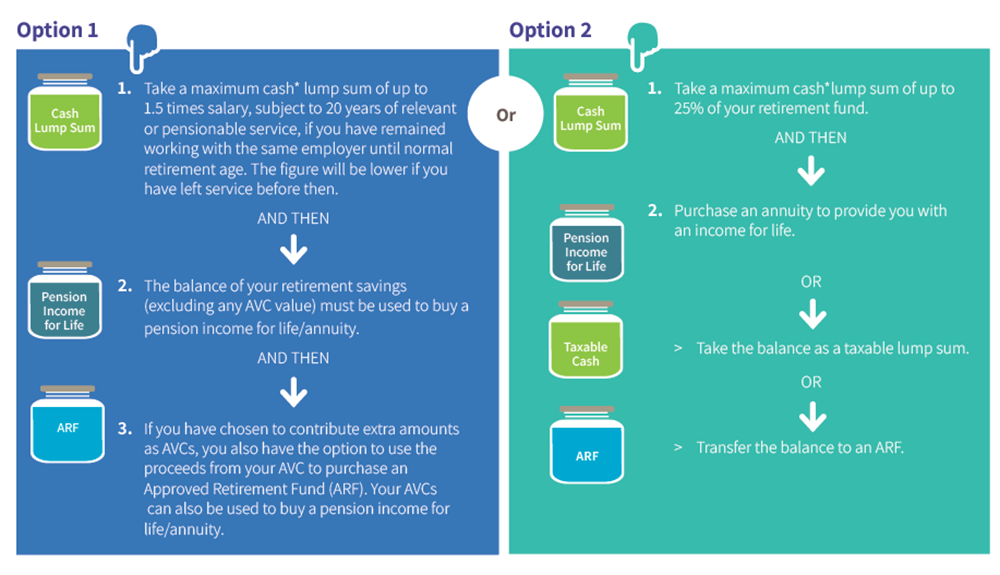

*Please note that the maximum overall amount of Cash Lump Sum that an individual can draw down tax free from pension arrangements over his/her lifetime is €200,000.

**These amounts may change (up or down) as specified by the Government. The amounts quoted are correct as at May 2022.

You may not be entitled to a lump sum at retirement if you have waived the right to a lump sum during a redundancy process.

Pension Pot Value

- If you are choosing the 25% lump sum route, the higher your pension fund value, the higher your lump sum will be in monetary terms. Pension pot values can be increased by contributing more, or by growth on the investment.

Salary

Revenue rules permit a number of options in relation to the salary on which the Cash Lump Sum is based.

- The salary* in the year in which you retire

- The highest salary* in the last 5 years

- The average of the highest 3 consecutive years salaries* in the previous 10 years

*This can be the Gross salary as per the P60 plus pension contributions for that year, or the rate of salary at a particular point during that year. You should note that the average of certain non-salary payments e.g. Benefit in Kind (BIK) or overtime, may be used to increase the salary for Revenue limit purposes.

Total Service

- Ensure the date of joining and leaving service are accurate.

- It is also important to ensure that any Transfer Values paid into the current pension arrangement are taken into account, and that the Cash Lump Sum is not solely based on the service with the current employer

Retained Benefits

If you have pension benefits with more than one pension provider/employer, it is very important that you make Irish Life (and your other pension provider, if relevant) aware of the other pension benefits to ensure that the Cash Lump Sum is calculated within Revenue limits

Can you make a last minute Single Premium Payment?

You may be eligible to make a last minute Single Premium payment to the pension scheme before you retire in order to maximise your Cash Lump Sum. Please discuss this with your financial adviser before making any payment to ensure that this is the best course of action for you. Also see our information on last minute AVCs, watch this video which might help, or read through the AVC webpage.

You may choose either a set pension amount, or one that starts lower, but increases by a set amount each year, to help offset the effects of inflation. You may also choose what will happen to your pension when you die. For example, it can stop immediately – or it can continue to be paid (in full or at a reduced rate) to your widow/er or civil partner.

We have a great selection of videos for you to watch, on demand, whenever it suits you.

Who can I contact for further information?

We’re here to help in any way we can.

|

If you want more information in relation to your pension plan, you should contact your broker or financial adviser. If you have a pension with Irish Life Corporate Business that does not have an appointed broker or advisor, you can also contact us at code@irishlife.ie or call 01 704 1845. |