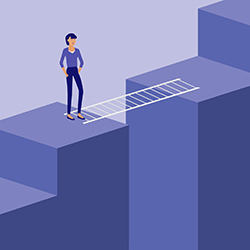

Less than half of women in Ireland have adequate financial protection, according to extensive research from one of the country's leading insurers.

The latest study from Irish Life has found that the number of women covered by life insurance, specified illness cover or income protection falls behind the number of men with such policies.

Just 45pc of women were found to have any form of cover to support them in times of financial difficulty compared with two thirds of men following the research by Coyne Research last December.

Senior Manager for Protection in Irish Life Retail, Sarah Kelly said that it was "worrying to see a stark lack of financial protection for women in Ireland".

"It’s really important that women take time to assess their own financial protection needs and what they can do to protect themselves and their family against any unexpected events," she said.

Irish Life's 2017 claims report also revealed that only one third of life insurance claims that the group paid out last year were to women, and the majority of specified illness claims (53pc) were also paid to men.

"We need to make women in Ireland more aware of the real benefits of life and specified Illness cover, as it can be a lifeline for them and their families in times of difficulty," said Mrs Kelly.

"Women are typically more pro-active when it comes to having these conversations but they don't have the policies in place."

Mrs Kelly believes that part of the reason for the imbalance may be due to the lack of value that stay-at-home mums believe they have.

According to the CSO, some 454,700 people - the vast majority at 98pc being women - state working in the home as their main role.

Recent cost-analysis research from Royal London reports that the average pay value for this job falls in around the €42,000 mark annually.

"Women working in the home need to realise that they have value, and that there would be a financial loss in the event of their death or serious illness," said Mrs Kelly.

Other insights highlighted in the claims report include the fact that women are claiming life insurance payments and specified illness payments at an earlier age than men (average 64 years to 67 years).

Furthermore, for specified illness claims, the average age for female claimants was 51-years-old in comparison to 55 years for male claimants.

Irish Life said that it paid out €187.8m to 2,582 customers and their families affected by illness and death over the course of last year.

Source: https://www.independent.ie/business/personal-finance/worrying-lack-of-adequate-financial-protection-for-women-in-ireland-research-36574286.html